Neco Financial Accounting Answers 2022 25th July 2022

Neco Financial Accounting Objective & Essay Answers 2022 for 25th July 2022 with questions 100% verified official questions and answers for senior secondary schools.

Monday 25th July 2022

Paper III & II: Objective, Theory & Practice – Financial Accounting – 2:00 pm – 5:50 pm

=================================

FINANCIAL ACCOUNTING OBJ

1EACCECCAEA

11EBADCBBEBC

21BDCBCCBCDD

31ADCABCCDCA

41BAABBCEACA

51ABDABCEDBB

Completed!

=================================

FINANCIAL ACCOUNTING ESSAY

INSTRUCTIONS: Answer. Five (5) Questions in All. Two (2) Questions from section A and Three (3) Questions from Section B

SECTION A

(1a)

(i)Discount allowed is the discount given to the customers for prompt payment of their account WHILE Discount received is the discount received from supplier for prompt payment of our accounts.

(ii) Discount allowed must be treated as an expenses and hence debited to discounts allowed and credited to the personal account of the customers WHILE Discount received is treated as revenue and hence it is credited to the discounts received account and debited to the personal account of the supplier.

(1b)

{PICK ANY FIVE}

(i) Purchase day book

(ii) sales day book

(iii) Return outwards book

(iv) Sales returns book

(v)Cash book

(vi) Petty cash book

(1c)

Two errors Trial balance can reveal are;

{PICK ANY TWO}

(i)Posting of the Wrong Amount

(ii)Wrong Totaling of Subsidiary Books

(iii)Posting an Amount on the Wrong side of the Account

Three errors that does not affect Trial balance are;

{PICK ANY THREE}

(i)Error of omission

(ii)Error of commission

(iii)Error of original entry

(iv)Error of principle

(v)Error of complete reversal of entry

*************

(2)

(i) Accumulated fund: An accumulated fund is a type of account that serves as the repository for funds that are collected over time by non-profit organizations and are above and beyond the money needed to cover operational and other expenditures.

(ii) Depreciation: It’s the reduction of a recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible.

(iii) Nominal Capital: It’s the amount of capital that a business can offer to shareholders, in the form of shares of stock. In most nations, the amount of this nominal share capital is regulated by governmental agencies that determine the financial stability of the business and the company’s ability to cover the value of those shares.

(iv) Bad debt: Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible and is thus recorded as a charge off.

(v) Net profit: is the amount of money your business earns after deducting all operating, interest, and tax expenses over a given period of time.

*************

(3a)

(i) Goodwill:

Goodwill is an intangible asset associated with the purchase of one company by another. Specifically, goodwill is recorded in a situation in which the purchase price is higher than the sum of the fair value of all visible solid assets and intangible assets purchased in the acquisition and the liabilities assumed in the process. The value of a company’s brand name, solid customer base, good customer relations, good employee relations, and any patents or proprietary technology represent some examples of goodwill.

(ii) Fictitious asset:

Fictitious assets have no physical existence or realisable value, but the company shows them as a cash expenditure in the books of accounts. They are a part of the assets column in the financial statements, and they are expenses or losses that do not get written off during the accounting period of their occurrence.

(iii) Gross profit:

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. Gross profit will appear on a company’s income statement and can be calculated by subtracting the cost of goods sold (COGS) from revenue (sales). These figures can be found on a company’s income statement. Gross profit may also be referred to as sales profit or gross income.

(iv) Turnover:

Turnover is an accounting concept that calculates how quickly a business conducts its operations. Most often, turnover is used to understand how quickly a company collects cash from accounts receivable or how fast the company sells its inventory.

(v) Balance sheet:

The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios.

(3b)

Loading

*************

Neco Financial Accounting Answers 2022: here are the verified Neco 2022 Financial Accounting Objective & Essay questions and answers for SS3 students for Monday 25th July 2022. Neco 2022 Financial Accounting Objective & Essay Questions and Answers.

Neco Financial Accounting Answers 2022: EXPO: Neco Financial Accounting Objective & Essay Questions and Answers 2022/2023, 2022/2023 Neco EXPO ON Financial Accounting Objective & Essay QUESTIONS, 2022 Financial Accounting Objective & Essay Questions & Answers is Out.

Neco Financial Accounting Objective & Essay Answers 2022

Monday 25th July 2022

- Paper III & II: Objective, Theory & Practice – Financial Accounting – 2:00pm – 5:50pm

Neco 2022 Financial Accounting Objective & Essay Questions and Answers

Neco Financial Accounting Objective & Essay Answers 2022: Welcome to the Expobite answer page where you will get verified and 100% authentic and correct Neco Financial Accounting Objective & Essay Answers 2022 for Monday 25th July 2022.

Examkey.net Financial Accounting Objective & Essay pin questions and answers for today, examkey, joberplanet, lasu-info, ceebook, noniwap, noniexpo, examspot, unn-edu, nairaland, utmeofficial, bestexamportal, loadedking.com literature Pin questions and answers for today.

Neco 2022 Financial Accounting Objective & Essay Questions & Answers

I know you really want to pass and get an A in your Neco 2022 Financial Accounting Objective & Essay examination? then follow the below to subscribe to our Neco Financial Accounting Objective & Essay exam runz/expo, we promise to send you both questions and answers at least 2 hours before the Neco Financial Accounting Objective & Essay 2022 examination.

Neco 2022 Financial Accounting Objective & Essay Questions and Answers Subscription Price List:

- To receive the Neco 2022 Financial Accounting Objective & Essay questions and answers through WhatsApp, the subscription price is ₦600 MTN airtime/recharge card.

- To have access to our Expobite Answer Page at https://expobite.net/answer-page/ where the Neco Financial Accounting Objective & Essay answer 2022 will be posted also using the 4 digits PIN/PASSWORD/KEY we will give you once you subscribe, the subscription price is ₦500 MTN airtime/recharge card.

- To receive the Neco Financial Accounting Objective & Essay 2022 questions and answers via text message/SMS, the subscription price is ₦1,000 MTN airtime/recharge card.

How to Subscribe

Kindly follow the below simple steps to subscribe to our 2022 Neco Financial Accounting Objective & Essay Questions and answers expo/runz for both Obj and Essay:

Choose your desired way of receiving answers

As I wrote above, we have 3 ways of sending questions and answers to our candidates, kindly choose between the 3 answer delivery methods available on our platform, ie, choose WhatsApp, PIN, or Text Message.

Transfer/Send Airtime to us.

You can either buy an MTN recharge card worth the subscription price to us or transfer it to our MTN line from your bank account through USSD or your Banking app.

Follow the below steps to successfully subscribe through the MTN recharge card:

– Buy a recharge card worth the amount of the subscription, open your WhatsApp and send the recharge card pins to us on 07062154881.

Follow the below steps to successfully subscribe through Bank airtime transfer (VTU):

– Open your bank app or USSD or go to POS and recharge our MTN line 07062154881.

We will confirm your subscription and get back to you immediately.

Neco Financial Accounting 2022 Answers & Questions for Practical, Neco Financial Accounting Objective & Essay Practical Questions and Answers 2022, 2022/2023 Neco EXPO ON Financial Accounting Objective & Essay QUESTIONS, Neco Financial Accounting Objective & Essay Questions and Answers for 2022/2023, Neco Financial Accounting Objective & Essay questions and answers, Neco Financial Accounting Objective & Essay Questions and Answers 2022/2023 Expo/Runs

I Will Send you the Correct 2022 Neco Financial Accounting (Objective & Essay) Questions and Answers, Neco 2022 Financial Accounting (Objective & Essay) Runs, Neco 2022 Financial Accounting (Objective & Essay) Expo, Neco 2022 Financial Accounting (Objective & Essay) Answers with Objective and Essay/Theory Exactly 5 hours Before the Exam. Neco 2022 Financial Accounting (Objective & Essay) Obj and Essay Questions & Answers

Neco 2022 Financial Accounting (Objective & Essay) Questions and Answers

We are pleased to inform all Neco students sitting for the 2022 Neco Financial Accounting (Objective & Essay) Exam that we have the complete Neco 2022 Financial Accounting (Objective & Essay) Expo with Questions Paper for May/June Neco Examination.

Did you know a good Neco result is your one ticket to admission to any University or Polytechnic of your choice? If you’re directed to this website pls subscribe now and smile while you write your exam.

How to Subscribe for Neco 2022 Financial Accounting (Objective & Essay) Answers.

Choose from the below subscription price list that best suits you, then send the exact amount as Mtn Recharge Card to us on 07062154881

TEXT MESSAGE: N1,000

WHATSAPP GROUP: N600

PASSWORD LINK: N500

See How to Make Payment For Neco 2022 Financial Accounting (Objective & Essay) Expo.

Send the following details:

- Your Mtn Card

- Your Subject Name

- Your Phone Number to 07062154881

Example:

8393994848484/Commerce/08123456789

Immediately after we have confirmed your details, the complete 2022 Neco Financial Accounting (Objective & Essay) runs will be sent to you.

WHAT YOU MUST KNOW

- If you supply Neco to your students or schools and you will need Neco Financial Accounting (Objective & Essay) question paper and answers contact us.

- No website would post free 2022 Neco Financial Accounting (Objective & Essay) answers online if they got the real questions paper direct from Neco officials like us. Beware of fake websites!!

- Most of the websites posting free Neco Financial Accounting (Objective & Essay) expo online are posting fake answers or copied ones with little to no knowledge of how it came about.

I HOPE THE DESCRIPTION PROVIDED ABOVE IS ENOUGH TO CONVINCE YOU WE ARE 100% REAL AND LEGIT.

Neco Financial Accounting (Objective & Essay) Answer 2022, Neco Financial Accounting (Objective & Essay) 2022, Neco Timetable 2022, Neco 2022 Syllabus, Neco Time Table Download, Neco May June exam Start When, Neco May/June 2022 Registration, Is Neco Registration Still on, Neco Financial Accounting (Objective & Essay) Nov Dec 2022.

FIN.ACCOUNT OBJ

1BDCBBACACC

11BBAABDDDCB

21CBADBDAADB

31BCBACBCAAA

41DDCDCCBBDA!

Completed!!!

ACCOUNT ESSAY

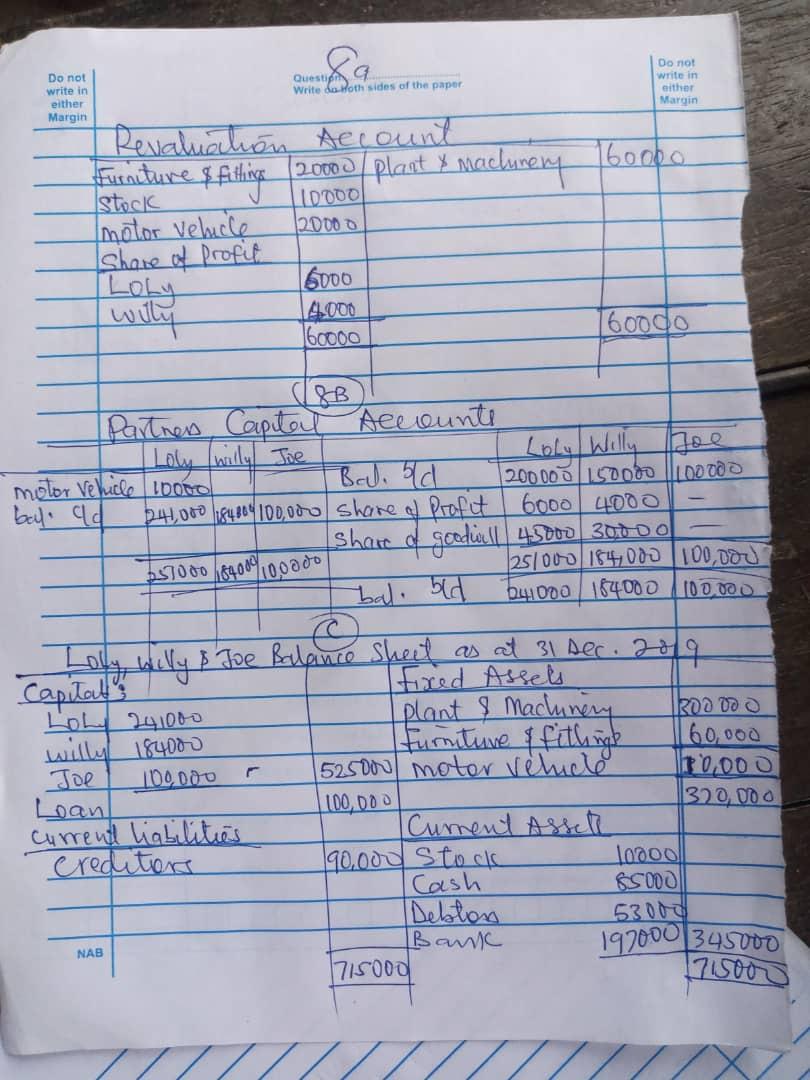

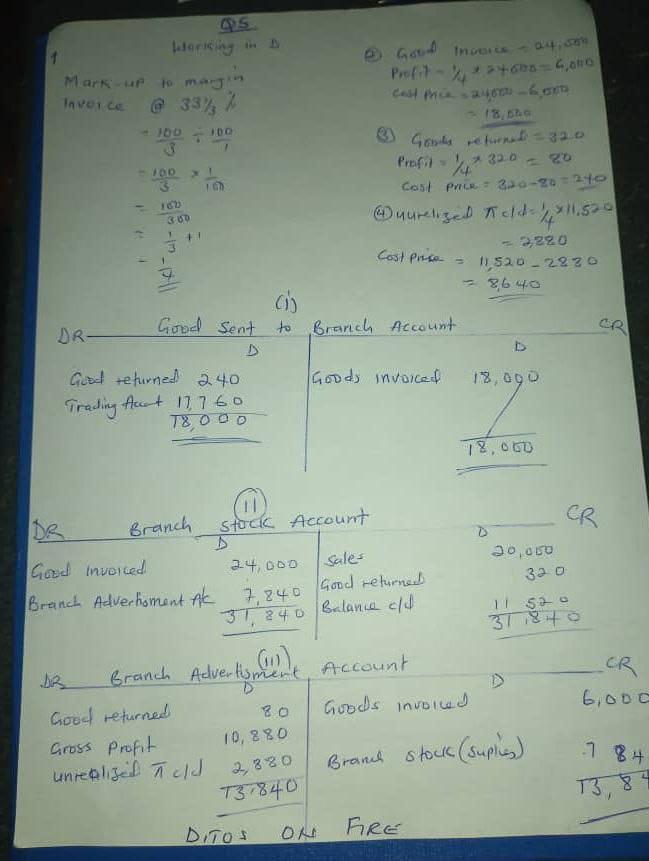

(7)

Mark up to margin invoice

(a) 33⅓%

= 100/3 ÷ 100/1

= 100/3 × 1/100

= 100/300

= 1/3 + 1

= 1/4

(b) Good income 24,000

Profit = 1/4 × 24,000 = 6,000

Coat price = 24,000 – 6,000 = 18,000

(c) Goods return 320

Profit = 1/4 × 320 = 80

Cost price = 320 – 80 = 240

(d) Unrealised c/d = 1/4 × 11,520 = 2880

Cost price = 11,520 – 2880 = 8,640

(i)

Goods sent to Branch Account

DR

Goods returned 240

Trading Account 17,760

Total = 18,000

CR

Goods involved 18,000

Total = 18,000

(ii)

Branch stock Account

DR

Goods invoiced 24,000

Branch Advertisement A/c 7,840

Total = 31,840

CR

Sales 20,000

Goods returned 320

Balance c/d 11,520

Total = 31,840

(iii)

Branch Advertisement Account

DR

Goods returned 80

Gross profit 10,880

Total = 13,840

CR

Goods invoiced 6,000

Branch stock (supplies) 7,840

Total = 13,840

============================

(2a) An imprest system of petty cash means that the general ledger account Petty Cash will remain dormant at a constant amount. If the amount of petty cash is ₦10,000, then the Petty Cash account will always report a debit balance of ₦10,000. This ₦10,000 is the imprest balance.

As long as ₦10,000 is adequate for the organization’s small disbursements, then the general ledger account Petty Cash will never be debited or credited again.

When the currency and coins on hand gets low, the petty cash custodian will request a check to replenish the coins and currency that were disbursed. Since the requested check is drawn on the organization’s checking account, the Cash account will be credited. The debits will go to the expense accounts indicated by the petty cash receipts, such as postage expense, supplies expense. In other words, the general ledger account Petty Cash is not involved in the replenishment. The petty cash custodian will cash the check and add the amount to the other cash.

(2b)

(Picl Any Two)

(i)Outdated System: Petty cash book is a largely outdated and inefficient system, and it does not fulfil the needs and expectations of the company’s current requirements.

(ii) Inconvenient for Larger Expenses: it causes huge inconvenience for larger expenses. The system is highly compatible and convenient for smaller expenses while opposite for larger expenses.

(iii) Overspending: Not setting the expenditure limits for every nominal transaction can even put an organization at the risk of facing overspending on purchases.

(2c)

(i) Petty Cash Vouchers are used to purchase tangible items from local suppliers who will not take a purchase order.

(ii) Petty Cash Voucher is used to control the disbursement of cash from the Petty Cash Fund.

(iii) it helps to financially control the petty cash accounts in order to make sure that no one can abuse or mismanage the funds in the petty cash fund.

(iv) it provides solid evidence when it comes to the reconciliation of the amount of cash that is left in the petty cash fund.

••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

(3ai)

Entrance Fees or Admission Fees is the amount that a person pays at the time of becoming a member of a Not-for-Profit Organization. It is a revenue receipt. Therefore, we account it as an income and credit it to Income and Expenditure Account.

(3aii)

A subscription is a signed agreement between a supplier and customer that the customer will receive and provide payment for regular products or services, usually for a one-year period.

(3b)

(Pick Any five)

(i) No Opening Balance:- Opening balance is not require to prepare income and expenditure account.

(ii) Accrual Basis:- Income and expenditure account is maintained on accrual basis.

(iii) Based On Receipt And Payment Account:- Income and expenditure account is prepared on the basis of receipt and payment account at the end of the accounting year.

(iv) Non-cash Items:- This account records non-cash items also

(v) Debit And Credit Rule:- Expenses and losses are debited and incomes are credited as it is a nominal account.

(vi) No Capital Transactions:- Only revenue items are included in income and expenditure account. So, capital items are excluded while preparing this account.

(vii) Only Current Year’s Transactions:- Income and expenditure account includes only current periods transactions.

••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

(4a)

bank reconciliation statement is a summary of banking and business activity that reconciles an entity’s bank account with its financial records. In other words the statement outlines the deposits, withdrawals, and other activities affecting a bank account for a specific period.

(4bi)

bank charges covers all charges and fees made by a bank to their customers. In common parlance, the term often relates to charges in respect of personal current accounts or checking account.

(4bii)

standing order is an instruction a bank account holder gives to their bank to pay a set amount at regular intervals to another’s account. The instruction is sometimes known as a banker’s order.

(4biii)

Credit transfer” means a payment transaction by which a credit institution transfers funds to a payee’s account on the basis of a payer’s order, and the payer and the payee can be the same person.

(4biv)

Dishonoured cheques are cheques that a bank on which is drawn declines to pay. There are a number of reasons why a bank would refuse to honour a cheque, with non-sufficient funds being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn.

(4bv)

unpresented cheque simply means that a cheque has been written and accounted for, but it has not yet been paid out by the bank from which the money is being drawn. Unpresented cheques are also referred to as outstanding cheques because the funds in question are, as the name suggests, outstanding.

(4bvi)

uncredited cheques represent money that is available to the company but has not yet been recognised by the bank. This comes in the form of cheques paid in by customers and clients.

••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

(1a)

Accounting concept refers to the basic assumptions and rules and principles which work as the basis of recording of business transactions and preparing accounts.

(1bi)

Business entity: This provides that the financial activities of a firm be kept separate from the personal affairs of its owner.

(1bii)

Accrual: This concept states that revenues and costs are recognized as they are earned or incurred, not as when money is received or paid.

(1biii)

Going concern:This assumes that a business will continue to operate intothe foreseeable future, unless something contrary happens.

(1biv)

Consistency: The concept of consistency means that accounting methods once adopted must be applied consistently in future

(1bv)

Periodicity: The concept provides that preparation and reporting of accounting information should be done at regular intervals to allow users to have access to information at all times, since decisions may be taken at any time.

(1bvi)

Historical cost: this concept states that the value of an asset is determined by the cost of its acquisition and not by the value of returns which are expected to be earned.

Neco Financial Accounting (Objective & Essay) Answer 2022, Neco Financial Accounting (Objective & Essay) 2022, Neco 2022 Financial Accounting (Objective & Essay), Alternative to Financial Accounting (Objective & Essay) Past Questions Pdf.